Reassessment of the Optimal Currency Area theory in the persistently heterogeneous European Union

Euro4Europe

A Research Project by Vilnius University Faculty of Economics and Business Administration

Despite the sizeable literature on BCA in the EU, so far only very few contributions have attempted to make causal inferences on the effects of the European integration on BCS in the countries affected by this integration process. Project aims to explore the impact of European integration on business cycle asymmetries (BCA) and provide empirical evidence on the long standing dispute among proponents of endogenous optimal currency area (OCA) theories, on whether integration increases BCA (as argued by Frankel and Rose, 1998) or decreases it (Krugman, 1993). Project will reassess the evolution of BCS in Europe in a unified framework and analyse it at different levels of territorial disaggregation.

MAIN RESEARCH AREAS

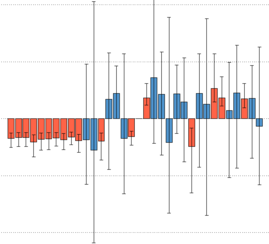

National Business Cycle Synchronization

A univariate and multivariate analyses at the country level will be conducted using alternative identification strategies in time-frequency domain. The directions of causal relationships will be identified by phase shift.

Economic Integration and Transmission of Macroeconomics Shocks

We will focus ontransmission mechanismsand the international business cycles (BC). Wewill make use and expanda global vector autoregressive (GVAR) model, developed by Pesaran et al. (2004), in order toassess the transmission of demand,supply and other macroeconomic shocks across European countries. The comparison of shock spilloversacross countries within the euro area and in other world regions will also provide evidence on the effects of integration on BC(a)symmetries.

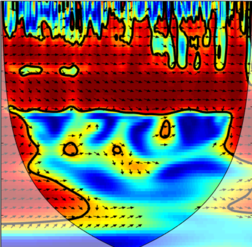

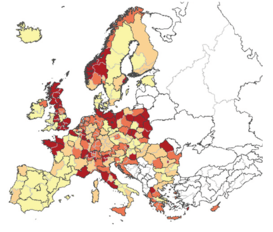

The Impact of Economic Integration on Regional Business Cycle Syncronization

We will analyse the effect of several integration events on BCS at the regional (NUTS2 and NUTS3) level which will allow to identify the causal effects of joining EMU on BC synchronisation using various identification strategies. It will also allow for an assessment of potentially heterogeneous and non-linear treatment effects.

THE TEAM

DR. SVATOPLUK KAPOUNEK

DR. DMITRIJ CELOV

SAULIUS JOKUBAITIS

Ph.D. POVILAS LASTAUSKAS

Ph.D. LAIMUTĖ URBŠIENĖ

KAROLIS BIELSKIS

Ph.D. RIMA RUBČINSKAITĖ

Ph.D. ANH DINH MINH NGUYEN

DR. GINDRUTĖ KASNAUSKIENĖ

DR. JARKO FIDRMUC

Ph.D. MARIAROSARIA COMUNALE

ROSITA KARIETAITĖ

DR. JESUS CRESPO CUARESMA

ŽYMANTAS BARANAUSKAS

Ph.D. ZIRAN DING

WORKSHOPS

1st WORKSHOP "ECONOMIC POLICY AND EUROPEAN INTEGRATION AT THE NATIONAL LEVEL"

19th December 2019, Vilnius University, Faculty of Economics and Business Administration

Regional Business Cycle Synchronization in the Long Run: Evidence from Austria

Dr. Svatopluk Kapounek, Principal Investigator “Euro4Europe” (Mendel University in Brno, Czech Republic)

Dr. Peter Huber, senior researcher (WIFO, Austria)

Business Cycle Synchronization in a Currency Union: Why Nobody Loves the Euro?

Dr. Jarko Fidrmuc, senior researcher (Zeppelin University of Friedrichshafen, Germany)

Measuring fiscal stress index in EU

Dr. Dmitrij Celov, researcher (Vilnius University)

Rosita Karietaitė, master student (Vilnius University)

Theoretical Application of Varieties of Capitalism to the Business Cycle Synchronization Field

Žymantas Baranauskas, PhD student (Vilnius University)

Karolis Bielskis, PhD student (Vilnius University)

Sectoral-Regional Business Cycle Synchronization in EU

Ph.D. Mariarosaria Comunale, junior researcher (Vilnius University)

Dr. Dmitryj Celov, researcher (Vilnius University)

The Cointegration of Baltic States with Main Trading Partners

Ph.D. Laima Urbšienė, senior researcher (Vilnius University)

Ph.D. Rima Rubčinskaitė, junior researcher (Vilnius University)

Saulius Jokubaitis, doctoral student, (Vilnius University)

Dr. Dmitryj Celov, researcher (Vilnius University)

2nd WORKSHOP

17th April 2020

Effects of Labour Market Institutions on Business Cycle Fluctuations

Žymantas Baranauskas, Ph.D. student (Vilnius University)

Passing European Financial Shocks through GVAR

Dr. Dmitryj Celov, researcher (Vilnius University)

Laura Gudauskaitė, junior researcher (Vilnius University)

Shocks, Housing Sentiments and Real Economy

Karolis Bielskis, Ph.D. student (Vilnius University)

Ph.D. Greta Juodžiukynienė, junior researcher (Vilnius University)

3rd WORKSHOP "ECONOMIC INTEGRATION AND THE TRANSMISSION OF MACROECONOMIC SHOCKS"

11th December 2020, MS TEAMS.

You can access recording here/Recording here.

Housing Spread, Credit Frictions, and Household Spending

PhD student Karolis Bielskis, Ph. D. Povilas Lastauskas (Vilnius University)

Impact of Exchange Rate Stability on International Trade within the Heterogeneous Euro Area

Dr. Svatopluk Kapounek (Vilnius University and Mendel Brno University)

A Coordination and Transmission Tale about Labour Market Reforms During Global Financial Crisis

Ph. D. Povilas Lastauskas, Julius Stakėnas (Vilnius University)

Global Impact of US Monetary Policy Uncertainty Shocks

Ph. D. Anh Dinh Minh Nguyen, Ph. D. Povilas Lastauskas (Vilnius University)

Uncertainty and Business Cycle Synchronization in Europe

Dr. Jesus Crespo Cuaresma (Vilnius University and Vienna University of Economics and Business)

4th WORKSHOP "THE IMPACT OF ECONOMIC INTEGRATION ON REGIONAL BUSINESS CYCLES SYNCHRONIZATION"

7th May 2021 MS Teams

You can access recording here/Recording here.

What matters for the economic synchronization of the Baltic States

Ph. D. Laimutė Urbšienė, Vilnius University

Synchronization or Asymmetry of Business Cycles at the EU NUTS 3 level

Ph. D. Rima Rubčinskaitė, Vilnius University

Exchange Rates in Emerging Markets in the First Wave of the Covid-19 Pandemic

Dr. Jarko Fidrmuc, Vilnius University and Zeppelin University of Friedrichshafen

Business Cycles in the EU: an Ultimate, Comprehensive Comparison Across Methods

Ph. D. Mariarosaria Comunale & Dr. Dmitrij Celov, Vilnius University

PUBLICATIONS

A block

Kapounek, S., Kučerová, H. (2019). "Historical Decoupling in the EU: Evidence from Time-Frequency Analysis", International Review of Economics and Finance, vol. 60(C), 265-280. https://doi.org/10.1016/j.iref.2018.10.018

Grigaliuniene, Z., Celov, D., Hartwell, Ch. A. (2020). "The More the Merrier? The Reaction of Euro Area Stock Markets to New Members". Journal of International Financial Markets, Institutions and Money. https://doi.org/10.1016/j.intfin.2020.101195

Fidrmuc, J., Campos, N.F., Korhonen, I. (2019). Business cycle synchronisation and currency unions: A review of the econometric evidence using meta-analysis, International Review of Financial Analysis, Volume 61, Pages 274-283, ISSN 1057-5219. https://doi.org/10.1016/j.irfa.2018.11.012.

Fidrmuc, J., Fiedler, P., Reck, F. (2021). Automation, Digitilization, and Income Ineaquality in Europe. Czech Journal of Economics and Finance, Vol 71, Issue 3, Pages 203-2019. https://doi.org/10.32065/CJEF.2021.03.01

Celov, D., Comunale, M. Business cycles in the EU: A comprehensive comparison across methods, Advances in Econometrics, Volume 44B, 2022 pages 99-146. (Forthcoming)

S. Jokubaitis, D. Celov: Business Cycle Synchronization in the EU: A Regional-Sectoral Look through Soft-Clustering and Wavelet Decomposition, arXiv preprint arXiv:2206.14128, 2022 (submitted to Empirical Economics)

B block

Crespo Cuaresma, J., Doppelhofer, G., Feldkircher, M., Huber, F. (2019). "Spillovers from US monetary policy: evidence from a time varying parameter global vector auto‐regressive model". Journal of the Royal Statistical Society: Series A., vol. 182, part 3, 831–861. Paper was nominated and won Vladas Jurgutis Award (2020) for significant research works by the Bank of Lithuania.

Crespo Cuaresma, J., Huber, F., Onorante, L. (2020). "Fragility and the effect of international uncertainty shocks". Journal of International Money and Finance. https://doi.org/10.1016/j.jimonfin.2020.102151, https://www.sciencedirect.com/science/article/pii/S0261560620300838

Jesús Crespo Cuaresma. (2022). Uncertainty and business cycle synchronization in Europe, Applied Economics Letters, 29:11, 1047-1053, DOI:10.1080/13504851.2021.1939854

Fidrmuc, J., Danišková, K. (2019). "Meta-Analysis of the New Keynesian Phillips Curve in Developed and Emerging Economies". Emerging Markets Finance and Trade. doi.org/10.1080/1540496X.2019.1590700 https://doi.org/10.1080/1540496X.2019.1590700

Fidrmuc, J., Lind, R. (2020). Macroeconomic impact of Basel III: Evidence from a meta-analysis, Journal of Banking & Finance, Volume 112, 105359, ISSN 0378- 266, https://doi.org/10.1016/j.jbankfin.2018.05.017.

Fidrmuc, J., & Degler, M. (2021). Temporal and Spatial Dependence of Interregional Risk Sharing: Evidence from Russia. Macroeconomic Dynamics, 25(1), 178-200. doi:10.1017/S1365100518000706

Dibooglu, S., Kapounek, S. (2021). The US current account, sustainability, and the international monetary system, Economic Systems, Volume 45, Issue 4,2021,100875,ISSN 0939-3625, https://doi.org/10.1016/j.ecosys.2021.100875.

Lastauskas, P. Nguyen, A. (2022). Global Impacts of US Monetary Policy Uncertainty Shocks (submitted to Journal of International Economics)

Lastauskas, P., Dainauskas, J., Comunale, M. (2022). What Explains Trade Persistence? A Theory of Habits in the Supply Chains (submitted to Economic Journal).

C block

Huber, P. (2018). "The role of migration as adjustment mechanism in the crisis and EMU". Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, vol. 66(6), 1497-1508. https://doi.org/10.11118/actaun201866061497

Fidrmuc, J., Moroz, S. & Reck, F. Regional risk-sharing in Ukraine. Empirica 48, 645–660 (2021). https://doi.org/10.1007/s10663-020-09500-7

Rubčinskaitė, R., Urbšienė, L. (2022). What Matters for the Economic Synchronization of the Baltic States (submitted to Empirica).

Kasnauskiene, G., Palubinskaite, J. (2020). Impact of High-Skilled Migration to the UK on the Source Countries (EU8) Economies, Organizations and Markets in Emerging Economies, 11(1), pp. 55-68. doi: 10.15388/omee.2020.11.23.

DATA

Population and Unemployment

Time Coverage: 1989-2017

Country Coverage: 26 Countries

Frequency: Monthly

Fiscal Stress Index

Time Coverage: 2000Q1-2020Q3

Country Coverage: 25 Countries

Frequency: Quarterly

Trade Openness

Time Coverage: 1960-2016

Country Coverage: 29 Countries

Frequency: Yearly

The Baltic States (Estonia, Latvia & Lithuania) & Trading Partners Business Cycle, Trade Intensity, Distance

Source: IMF IFS, IMF DOTS

Time coverage: 1995 Q1 - 2019 Q4

Country coverage: 21

Frequency: quarterly